When I think about old people in the UK, it looks something like this:

“A few million little old ladies in their 70s, surviving on the state pension, visiting the doctor because they’re lonely (all the older men are dead). They have some nostalgia about the war”

There’s two things about this image of older people:

1) it is very commonly held

2) It is completely wrong.

Just how wrong are we talking?

If the description above seemed familiar to you then you’re likely over 30 and your idea of an older person solidified in the 1990s or earlier, when that view was much more accurate. If you’re under 30 it may still seem familiar thanks to a cultural lag that maintains TV characters like Dot Cotton.

To realise how wrong we are, let’s look at total numbers, first the 90s when I was a kid:

The first thing you notice is there are not a lot of old people, especially compared to those in their 20s and 40s. The second thing you notice is that the “Baby Boom” (the increase in births in the 1940s and 50s), is a case of American cultural imperialism confusing us Brits. What we had in the UK was a very small post-war boom, which was stymied by rationing and everything generally being shit, before a proper fertility boom in the 1960s, when everyone was encouraged to shag each other, even Philip Larkin got laid.

Finally you’ll note my first point about the lonely little old ladies certainly rings true, the right hand of the population significantly chunkier than the left.

Comparing to 2022, the picture has changed a lot:

The little old ladies now have more little old men to keep them company. In fact there are just so many more old people - not only have medicine and office jobs enabled us to have loads more people in their 80s and 90s, but our first set of boomers, the 1945-49 group have basically all survived and retired to enjoy Strictly Come Dancing and housing wealth1.

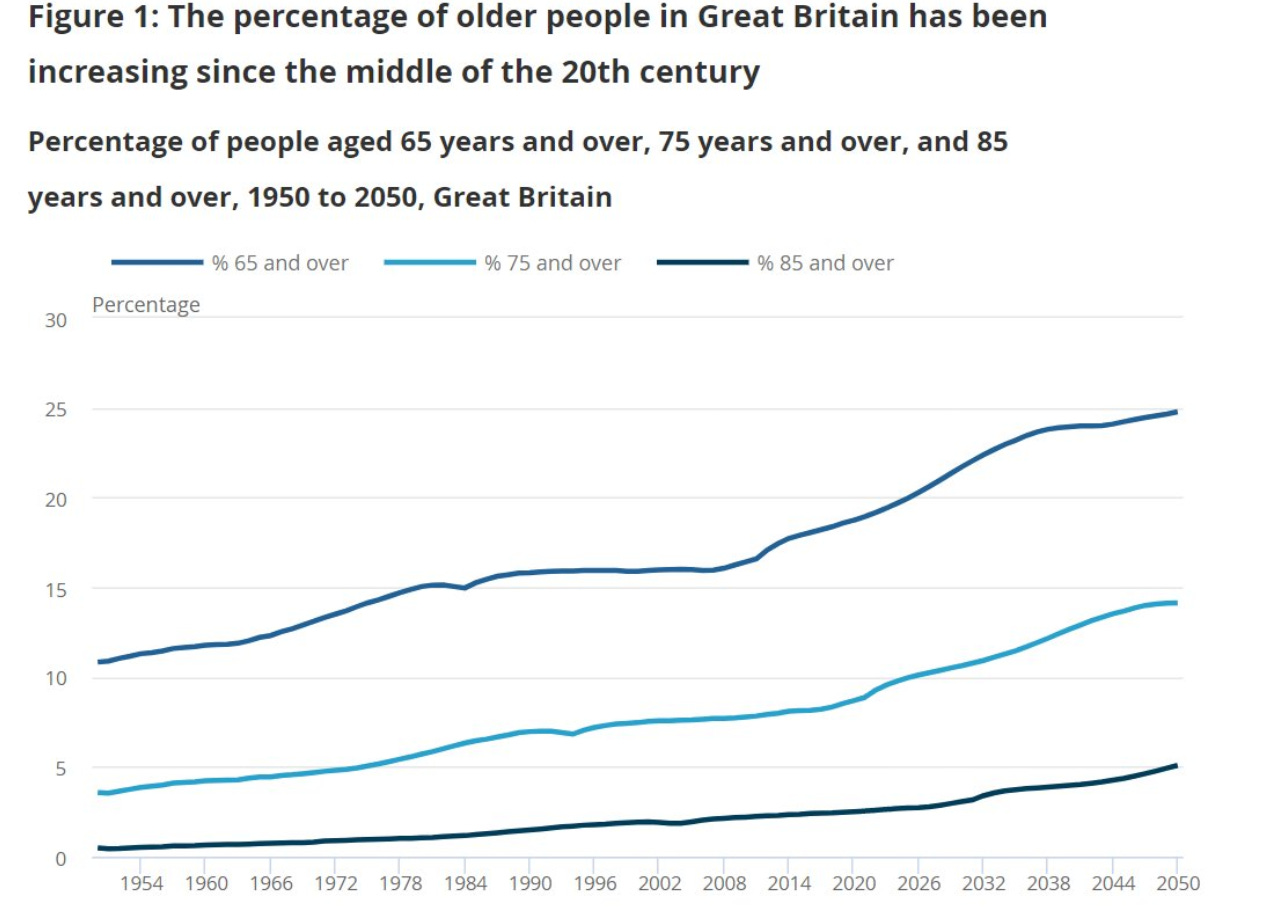

In 1990, the median age was 35.8, in 2022 it is 40.4. In 1990, the percentage of people over 65 was about 16%, now it is closer to 20%. It isn’t just that there are loads of old people, its that older people are becoming a greater proportion of the UK population.

For better or worse, immigration has been used to offset this trend, importing foreign young people to try and brute force the population pyramid, but still we’ve seen the proportion of old people grow significantly, as immigrant fertility rates track to the mean of native rates through the generations, meaning any improvement is temporary.2

I’m not really concerned about the situation as it is now though, even if we misunderstand it. What I am concerned about is that our real boomers, those born from 1960 to 1970(ish), haven’t really started retiring yet. And when they do, well:

The ONS is currently forecasting that 25% of the UK population will be over 65 by 2050. 2050 sounds a long way away, so let me say it another way:

In ~25 years a quarter of all people in the UK will be over 65.

But there’s more this than just pure numbers. Old people aren’t just getting more numerous, they’re healthier too. The proportion of people in a cohort who are disabled has two jumps in the 50s and 80s. Otherwise disability only increases incrementally as a proportion. These oldies are pretty healthy, despite the best efforts of the NHS.

One thing everyone “knows” about old people is they’re rich, and the stats broadly back that up, at least if you think of housing wealth as real savings:

Also, consider how culturally powerful old people are nowadays. In the 2000s people were worried about ageism and occasionally you still see articles about the “cult of youth” but lets consider some still culturally relevant oldies. From the mini boom we have people like:

Paul McCartney - 80 years old

Maggie Smith - 87

From the second larger boom we have people like:

Stephen Fry - 65

Nick Cave - 65

Yes, Stephen Fry and Nick Cave are old, deal with it. To return to our inaccurate picture, this:

A few million little old ladies in their 70s, surviving on the state pension, visiting the doctor because they’re lonely (all the older men are dead). They have some nostalgia about the war

Becomes this:

12.7m people ranging from their 60s to their 90s, holding more wealth than any other cohorts, who don’t actually need to go to the doctor that much. They have nostalgia about The Beatles

There’s just loads of old people - if you think back when we would all be watching the progress of the covid vaccinations, just how long it took to get through the “at risk” groups, i.e. older people. It took ages! Now extrapolate that feeling to life in general, and realise we’re only at the start of the process of the country aging.

So what does this mean?

If you were 65 in 1990 you could expect to live another 10 years, and frankly you probably weren’t going to be doing much with your time. In 2022 you can probably expect to live double that, and be healthy whilst doing so. Some of your pals could live for another 30 years. This has consequences.

We need to get a grip on our image of what an old person is. My Mum is in her early 70s, and recently went to a charity coffee morning for little old ladies. My Mum saw the Beatles live when she was a teenager and her favourite band is Fleetwood Mac (tied with the Eagles, both of whom are still touring). The coffee morning was playing stuff like Vera Lynn, things her parents would have liked.

Which is to say, if people who are dealing with older people day in, day out can’t get it right, what hope does the government have?

One thing to worry about is pensions and savings. You could look at the chart above and think "boomers are rich". I look at it and think boomers are completely screwed if property prices fall, as so much of their savings are housing related. They have no cash savings and that £200k median pension pot will pay you ten grand a year, even with interest rates on the rise.3

You want to fix housing? So do I. When we say that all recent housing ideas designed to help buyers (50 year mortgages?) are also designed to support house prices, it is true! But it is only partly to buy boomer votes. The alternatives (various ways of increasing supply) are just as much of a headache for younger cohorts. If you suddenly reduce house prices, you need a plan to support boomer wealth, because falling house prices impoverishes them. Want lower house prices? Me too, but we’ll be paying for them somewhere down the line. If the elderly can’t draw on housing wealth, and their pensions are crap, then there will need to be a fiscal transfer between workers and pensioners to support pensioner living standards. That means either higher taxes or lower spending somewhere else.

In effect we’re already doing this, with the restriction in housing supply pumping valuations for older homeowners whilst causing high rental and mortgage costs for younger generations; remove that subsidy via planning, and you need to replace it - for too many people retiring over the next 20 years their home is their pension (how many times have you heard that?)

Ah, so we’ll just smash the boomers and make them poor? You haven’t understood anything I’ve written; they’re going to be ¼ of the population so putting to one side the morality of returning to pensioner poverty, they will kick your head in at the ballot box. So whatever your housing plan, make sure it stuffs boomer mouths with gold.

This leads to a wider issue. I mentioned in my Worried About Deano post that pensioners already have a “class consciousness” - they understand where they fit in society. But what happens when this group continues to get bigger, and has an effective electoral veto over policies that improve things at the expense of things they value? Pensioners are going to gradually have an even greater influence over an economy they no longer actively participate in.

We’re already seeing this play out. A trial of E-scooters, a fun little alternative to bicycles, was recently cancelled in Kent. Skim the story and you’ll see everyone involved in the decision is old; the people opposing them, the councillors involved, everyone. This will happen more and more, as healthy 70 year olds jump out of bed every morning fresh and rested, ready to engage with what’s going on in the country, with significantly more free time than those who may disagree with them.

There aren’t any easy answers, and it is completely wrong to see older cohorts as the enemy. We all have to get our heads round the fact that there will be more old people, they’re going to be healthier and that culturally and politically they are not going away.

Want to reform housing? You need to help those who used their house as a pension. Want to reform the NHS? You need to consider how much of its service set up for older people now. Want to reform immigration? You’re going to need to support women who want kids to have more of them, and that costs money, otherwise you’re not paying pensions. An aging population is a consideration for everything you might want the government to do.

People really underestimate that there was a reason houses cost 1p in e.g. central London in the 60s/70s; it was a complete dump, and boomers actually had to live there before it became nice. Yes it is gentrified now, and yes the value uplift is greatly increased by supply constraints, but you're forgetting that as late as the 80s there were parts of Zone 1 which were slums.

My Nan had five children, and each of them had… one child each.

Anonymous troll Iron Economist thinks that this misses two points, one I think matters, and one I think matters less. The one that matters less to me is that annuity rates will be significantly higher than I expect; even if this is true, a higher income derived from a small endowment is still not going to deal with the issues I’m looking at. Much more important is that my analysis misses the value of defined benefit pensions. This is a much more significant, and probably means “impoverished” is an exaggeration. The politics of making 25% of the population poorer, remains the same however.

This just reinforces a particular idea to me. Restricting the vote and ability to engage in politics, whether that be at a national or local level, to those who can contribute to the future, whether that is by participation in the economy, or by raising families. Both are not, one by definition and one by biology for most, with a few exceptions, able to be done by the retired. I suspect future mass enfranchisement liberal democracies will be moribund and unable to compete with another nation that successfully throws off such vile shackles of the past, ceteris paribus that is.

Also an issue that the old don't want to sell their homes, and generally refuse to do so unless forced. Population of London has gone up over the last 25 years from 7 to 9 million, and house sales per year have gone down (very, very roughly, see https://www.plumplot.co.uk/London-property-transactions.html) from 150,000 to 100,000. Add in the fact that newbuilds are disproportionately flats, and the supply of housing that you might want to move into as you have a family - the sort of properties today's old people moved into thirty or forty years ago - is abysmal.

And if people fundamentally just want to live in their homes until they die, with those homes and their neighbourhoods unchanging, even if that means not having any money, then changing SDLT rates or introducing street votes might have less of an effect than is hoped.

I think the strength of that desire is underestimated by younger people. There are many old people, including some I know, who prefer to be poor in their own home rather than become rich by selling it and moving somewhere smaller and more comfortable. I'm not sure they're wrong, or that I'd make a different decision in a few decades' time.